Class 3 Digital Signature for GST: A digital signature certificate is used to authenticate online data and Information. This is mainly used on the government portal where the need to validate user documents and information. for this purpose, a valid Class 3 Digital Signature is required. Class 3 certificate is highly secured and can be used on all Government portals. It is mainly used on GST, ITR, MCA, and EPFO portals for registration and return filing. Filing GSTR on the GSTN portal requires a valid Class 3 DSC. It is issued with the name of the authorized signatory.

Table of Contents

Can Class 3 DSC be used for GST?

Yes, Class 3 DSC can be used for GST. From January 1, Class 2 DSC has been discontinued by the government, so now Class 3 DSC will be used instead of Class 2 DSC. If you already have class 2 DSC and its validity remains, you can use it. Now whatever new DSC will be made will be of class 3 and it will be used on all portals. For GST registration and return filing, only the digital signature certificate of class 3 will be used.

A valid Class 3 Digital Signature is required for GST registration and GST filing in India. Under GST, registration applications or documents and returns uploaded on the GST portal must be digitally signed. Therefore, a Class 3 digital signature must be obtained for the authorized person.

What Documents are required for GST DSC?

Some basic documents applicants require to apply for DSC.

- Applicant Pan card

- Address proof: Adhar card/Driving license/ Voter ID

- Email id and Mobile Number

How to apply Class 3 Digital Signature for GST

The application process for Class 3 DSC is completely online. You only need to submit Pan details, email, and mobile numbers. Need to complete email and mobile verifications by OTP. One video verification is also required that can be completed by mobile or laptop. After complete documentation and verifications, your DSC is ready and can be downloaded in a USB token. You can download DSC in your existing USB tokens like epass2003 auto token, Watchdata Proxkey token, mToken, etc.

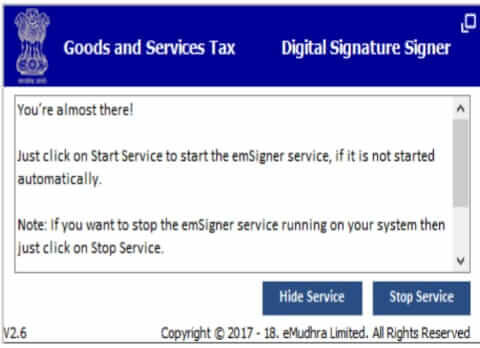

How to update DSC on GST Portal?

- Open and Run the GST emSigner utility application

- Login to GST Portal and go to the profile section

- Click on ” Register / Update DSC”

- In the dropdown, select the Signatory Pan number and Click on update

- Your DSC will be “successfully updated” on GST Portal

If you want Complete details regarding “How to Register DSC on GST Portal” Read Here

Finally, We hope the above information will be helpful for you. we provide Class 3 Digital Signature at the offer price. Contact us:

Call / WhatsApp: 09784417276

email us: apiinfotechindia@gmail.com